According to a new report by global real estate consultant Knight Frank, with capital growth in most prime residential markets around the world shrinking in 2019, the global economic landscape looks markedly different from that a year ago.

In 2018, economists predicted ‘the new normal’ – that of higher interest rates and more expensive debt – yet it failed to materialize. Instead, Knight Frank has seen interest rate cuts globally in the last year, with quantitative easing (QE), once an extraordinary measure, now back on the agenda in the US and the Eurozone.

With interest rates remaining lower for longer, property’s attraction has been reinforced. Yet, at the prime end of the market, particularly in the world’s top tier cities, sales volumes largely drifted lower during 2019.

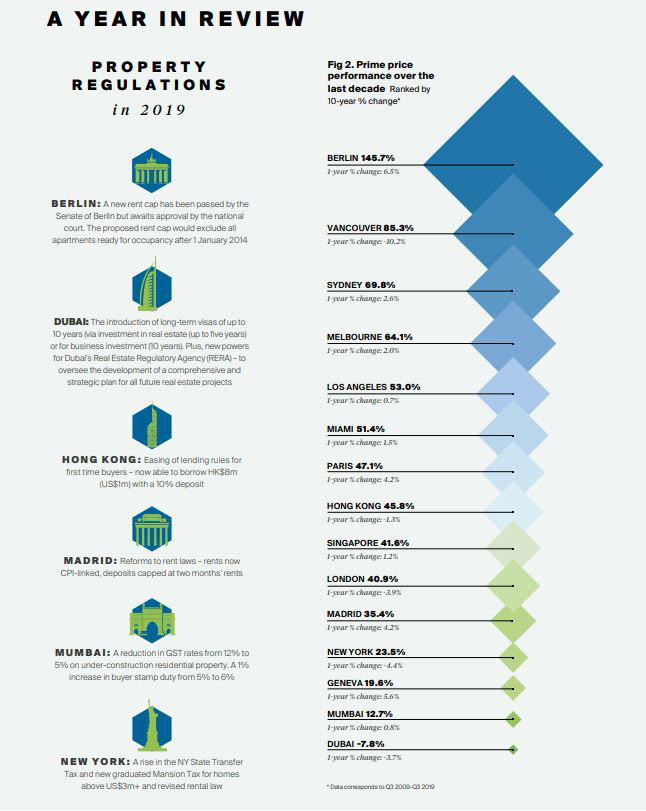

Prime price growth also stumbled in 2019 across many cities. The Knight Frank Prime Global Cities Index, which tracks the movement in prime prices across 45 cities worldwide, is mirroring global economic growth. The average annual rate of growth in the year to Q3 2019 was 1.1%, meaning prime prices are rising at their slowest rate in a decade.

Key report findings:

- Paris leads Knight Frank’s prime residential forecast for 2020 with price growth of 7%. Stable economy, low interest rates, constrained prime supply, strong tenant and second home demand will underpin prime price growth.

- In second place sits Berlin and Miami, where Knight Frank expects to see prime price growth of 5%. Strong demand and significant regeneration will keep Berlin high in the rankings. In Miami, Knight Frank expect the city to benefit from continued momentum from the State and Land Tax deduction.

- At 4%, Geneva and Sydney are both seeing prime price growth recover having dipped in recent years. Confidence has returned due to lower interest rates and limited supply. Both cities are recipients of significant transport infrastructure.

- Knight Frank expects to see Madrid, Singapore and Melbourne to register price growth of 3%. International inquiries (Madrid), redirected capital outflows (Singapore) and a lower interest rate environment (Melbourne) shoring up demand.

- In LA, forecast of 2% hides a complex picture. Below US$2m the market is active with strong demand for quality properties. Above US$10m, the market is slow.

- From the interminably tedious Brexit negotiations to the US/China trade tensions, Hong Kong protests and climate change, the level of uncertainty ramped up in high gear in 2019. But what about 2020?

The 2020 Forecast

Paris leads Knight Frank’s prime residential forecast for 2020 with price growth of 7%; economic stability, low interest rates, constrained prime supply and strong tenant, as well as second home demand, will underpin price growth. Home to Europe’s largest infrastructure initiative, the Grand Paris Project, as well as the 2024 Summer Olympics, both events will provide further stimulus.

In second place, sit Berlin and Miami. Knight Frank expects both markets to see prime price growth of 5% in 2020 but for different reasons. Sound fundamentals – strong demand (domestic and international) and significant regeneration – will keep Berlin high in the rankings despite the proposed rent cap.

In Miami, the city will benefit from the continued momentum from the State and Land Tax (SALT) tax deduction. At 4%, Geneva and Sydney are both seeing prime price growth recover having dipped in recent years. Confidence in both residential markets has returned due to lower interest rates and a limited supply pipeline.

Both cities are also the recipients of significant transport investment; the Leman Express (CEVA) in Geneva and in Sydney, the CBD & South East Light Rail.

The next grouping can be defined as steady yet sustainable. Although at different stages of their market cycles Knight Frank expects Madrid, Singapore and Melbourne, to register price growth of 3% in 2020 with international inquiries (Madrid), redirected capital outflows (Singapore) and a lower interest rate environment (Melbourne) shoring up demand.

In Los Angeles, Knight Frank’s forecast of 2% hides a complex picture. Below US$2 million the market is active with strong demand for quality properties, above US$10 million the market is slow, patchy at best, whilst the mid-segment US$2- US$10 million is registering moderate price appreciation.

Against a tumultuous political backdrop, Knight Frank expects Hong Kong’s luxury segment to see largely static prime prices (0%) in 2020. Research shows the Hang Seng Index leads the mass residential market by three to six months but luxury prices are largely resilient with a weak correlation to both GDP and equities. A number of high-end transactions in The Peak in 2019 would support this argument.

For Mumbai (-1%) the economic environment deteriorated in 2019 influencing market liquidity, this was further exacerbated by an additional 1% stamp duty taking the total to 6%. Knight Frank believes prime buyers to remain cautious in 2020. In London, all eyes are on the General Election, Knight Frank’s 2% forecast from a year ago will be updated once the final outcome and the future timetable in relation to Brexit. For now, the indication is that pent-up demand is building – for every new property listed in prime London in September, 14 new prospective buyers registered with Knight Frank, the highest level in more than ten years.

For Dubai (-2%), 2020 marks a landmark year when it will host Expo 2020. Forecast to attract 25 million visitors, the city has seen significant investment in new infrastructure in the lead up to the event, such as the expansion of the Metro Line. These changes, along with the introduction of long-term visas of up to 10 years, will boost prime demand.

In New York (-3%), Knight Frank expects lower mortgage rates and strong employment indicators to start to cancel out the high completion rates seen in recent years.

Despite sitting at the bottom of Knight Frank’s rankings for 2020, Vancouver’s -5% decline in prime prices reflects an improving scenario. Prime prices have been falling at a rate of 15% per annum but shrinking inventories, along with a gradual adjustment to the property market regulations, are seeing a slow recovery in buyer sentiment.

Source: World Property Journal