MIAMI BEACH, Fla., October 22, 2019 (Newswire.com) – With the looming possibility of economic slowdown, some family offices (i.e. investment firms that work for ultra-rich families) in the U.S. are focusing more on hedging their bets in real estate, as compared to exposure to hedge funds. A recently released report on family offices by UBS and Campden Wealth Research reveals that nearly three-fourths of the surveyed 360 family offices invest in real estate. The report states that, on a global level, the biggest lift in portfolio allocations for family offices was experienced by real estate. Real estate accounted for an average of 17%, which is considerably higher than the 4.5% investments in hedge funds, according to the report.

In North America, it is forecast that around one-fifth of family offices will raise their real estate allocation on a net basis in 2020. It is reported that direct investment in real estate accounts for 14% of the average portfolio of a family office in North America. On the other hand, for some family offices in North America, hedge funds are falling out of favor, with an average portfolio allocation of 6%. This is mainly because family offices are doubtful about the ability of hedge funds to protect funds in times of economic slowdowns.

Raphael Sidelsky, Chief Investment Officer at W5 Group LLC, is of the view that real estate of high quality in an area that is strongly in demand, without excess supply, has the ability of withstanding an economic turndown well, and during the recovery period, it can then provide an upside. Miami is one of such places where luxury real estate is significantly in demand, without an excess supply of it. Buyers from New York and California are flocking to Miami as tax refugees, raising up million-dollar properties to significantly reduce taxes.

Major states in the USA, which include California, New York, Connecticut, Illinois and New Jersey, are subject to an imposition of a high-income tax of 13.3%, as compared to no state income tax for Miami. Therefore, high-earning professionals, big-time entrepreneurs and real estate bigwigs have been observed to acquire luxury homes in Miami.

Miami is one of the top-ranked cities in the world, with good weather conditions and air quality and tremendous business and work opportunities. Consequently, the place also attracts foreign investors. With family offices now also interested in real-estate investments, Miami is likely to experience a further increased demand for real estate.

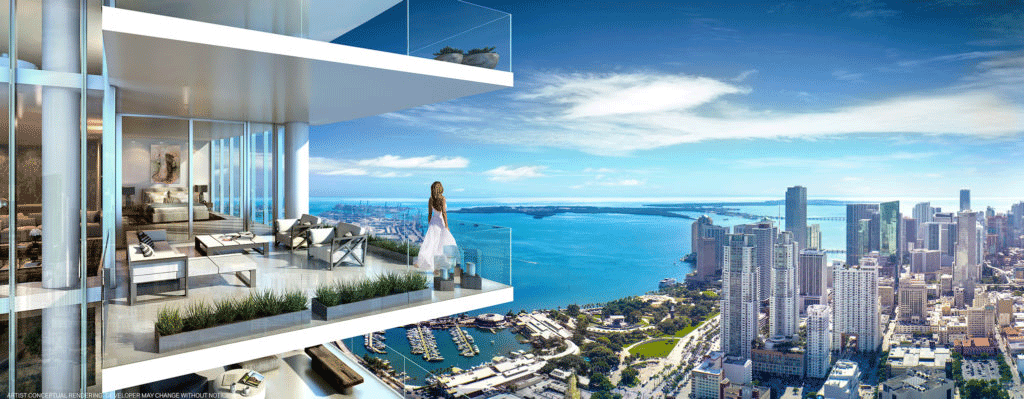

Miami is a beautiful place with some enchanting beaches and breathtaking luxury real estate. Miami Luxury RE LLC is a boutique real estate Miami brokerage dedicated to assisting High Net Worth Individual (HNWI) buyers and sellers with their Miami real estate needs. These include local, as well as international, buyers.

For all your Luxury Real Estate needs, please call Miami Luxury RE LLC, +1-855-75-MIAMI (64264), or visit www.miamiluxuryrealestates.com.